March 9, 2025 - 10:35

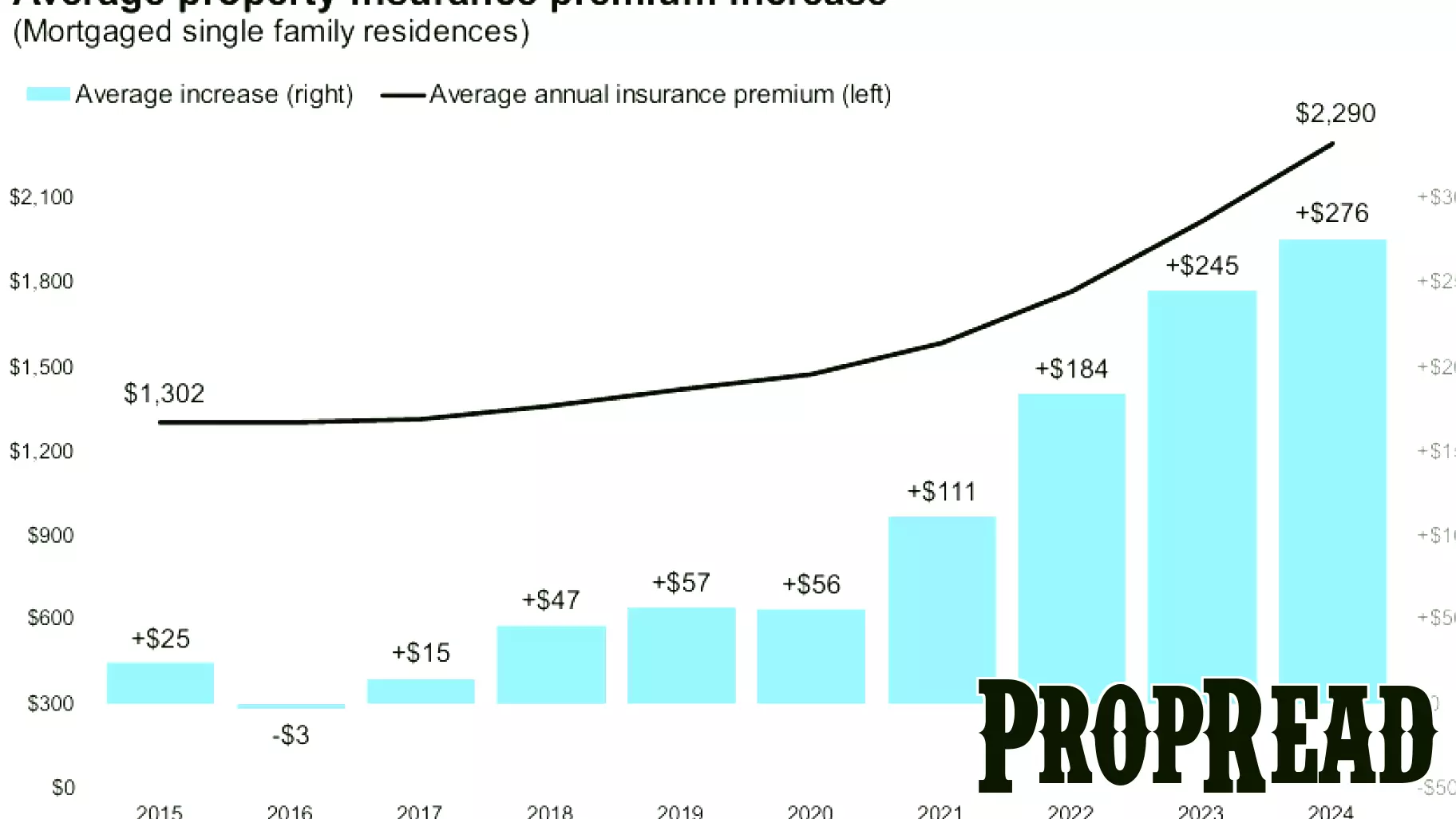

This week, the real estate landscape has been significantly impacted by a dramatic rise in property insurance costs, reaching unprecedented levels in 2024. The latest data reveals that homeowners and property investors are facing steep increases in their insurance premiums, prompting concerns about affordability and market stability.

The surge in costs can be attributed to various factors, including heightened risks associated with climate change, increased frequency of natural disasters, and a tightening insurance market. Insurers are adjusting their rates in response to these evolving risks, which has resulted in a substantial financial burden for property owners.

As the real estate market continues to navigate these challenges, stakeholders are urged to stay informed about the implications of rising insurance costs. This trend could influence purchasing decisions, investment strategies, and overall market dynamics. With many homeowners feeling the pinch, the future of property insurance remains a critical topic for discussion among industry experts and consumers alike.